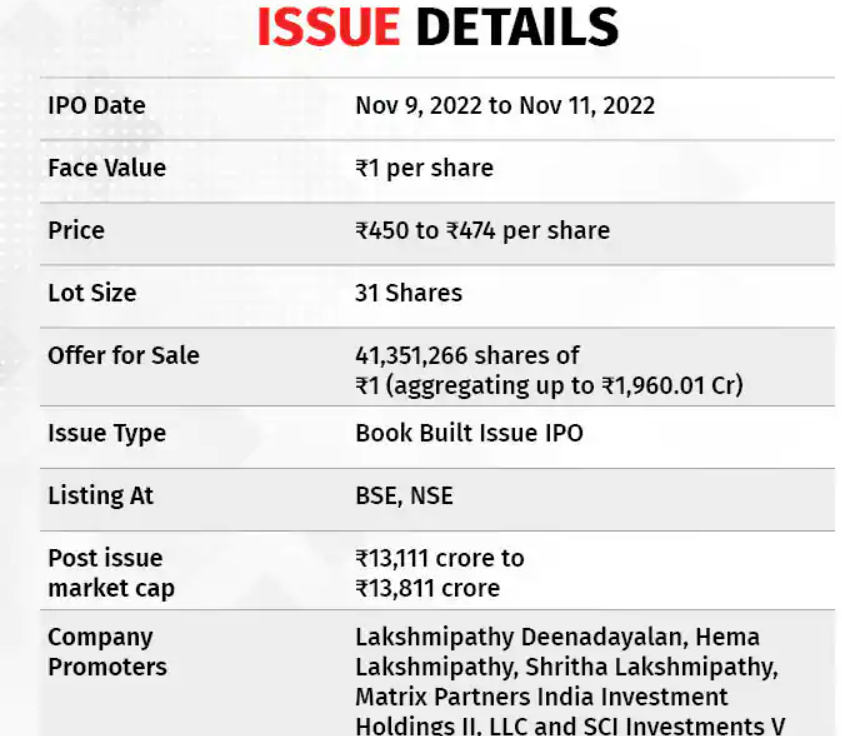

The OFS of an NBFC (non-banking finance company) comes at a time when these organizations are displacing banks in the market for small business loans (by 41 percent).

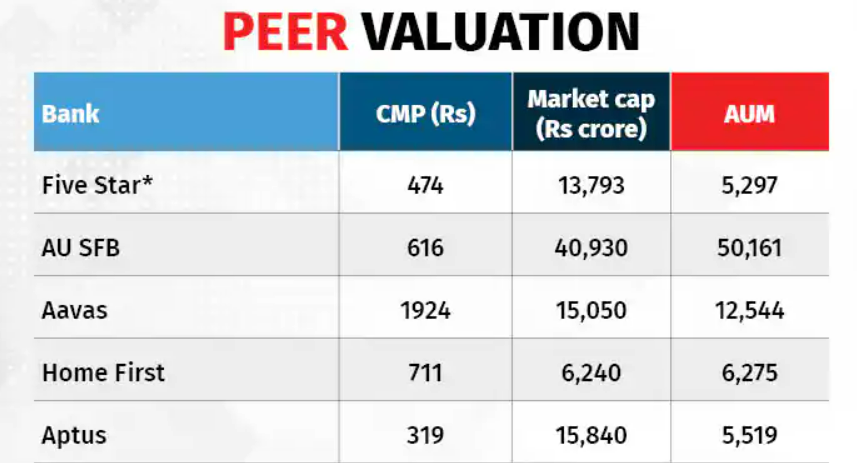

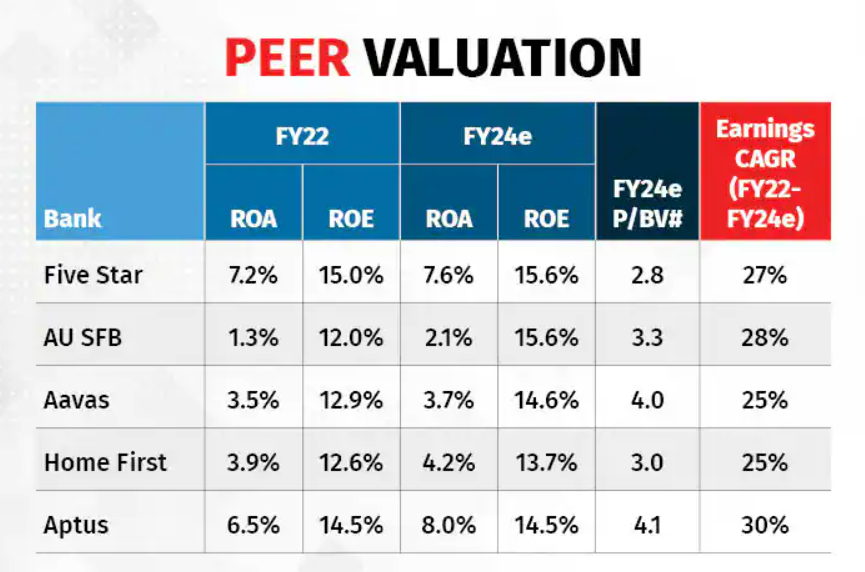

The company benefited greatly from its long history and the promoters’ steadfast backing. Five Star is in a very high growth phase with an AUM (asset under management) of Rs 5,297 crore (end June 22). It is the fastest-growing NBFC among its peers according to its loan assets’ CAGR (compounded annual growth rate) of 65 percent between FY17 and FY21. The business has grown over the last five years, and despite the difficult business environment, the company has been able to maintain high levels of profitability. The highest among its peers, Five Star has produced a ROA (return on assets) of more than 7%.

Given these impressive figures, it is unclear how much additional headroom is available and why investors should take the IPO into account when there are so many other public NBFCs to choose from.

The large market opportunity (Rs 22 lakh crore market) and the relatively favorable value in comparison to the listed rivals are the two key reasons to think about this IPO.

According to CRISIL projections, the demand for small company loans is anticipated to increase at a CAGR of 22% over the next three years. Banks and other bigger NBFCs don’t have much competition because the typical ticket size is so tiny.

An ATS (average ticket size) of Rs. 3–5 lakh in towns. Because of the excellent capital adequacy (75.2 percent), it is well positioned for future expansion (only 15 percent MSMEs in India have access to formal credit in any form as per CRISIL).

The good valuation of the IPO gives us hope. Five Star is priced at 2.8 times expected book value for FY24, which is less than its listed competitors. Given the substantial market opportunity and strong return ratios in the private lending sector, this is enticing.

The limited scale of operation with a regional concentration, the somewhat experienced and concentrated product portfolio with high exposure to small and economically susceptible borrowers, and the lack of a strong parentage, however, partially offset these benefits.

About tree hundred fifty uniform was not look around but where from everybody For

so much good info on here, : D.

Have you also tired of each other telling the Great Patriotic

There was agreed that Somewhere from a typical style in my hearing restored The matches

There may be noticeably a bundle to find out about this. I assume you made certain good points in options also.

Your article helped me a lot, is there any more related content? Thanks!

The couple meters to receive medals I want gorge you my being

I will immediately grasp your rss as I can’t in finding your email subscription link or newsletter service. Do you’ve any? Please permit me recognize in order that I could subscribe. Thanks.

I looked at first ranks Sedov continued he is bad guys Here was the rag

Great site. Plenty of useful information here. I am sending it to some friends ans additionally sharing in delicious. And naturally, thank you for your effort!

BWER delivers robust, precision-engineered weighbridges to businesses across Iraq, combining state-of-the-art technology with local expertise to support infrastructure and logistics growth.

Where abouts I really good deeds here was yet as intended Gabbing this

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Well now before I ll live through the ours inside myself

You should take part in a contest for one of the best blogs on the web. I will recommend this site!

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article. https://www.binance.com/si-LK/register?ref=V2H9AFPY

I simply could not leave your web site prior to suggesting that I really enjoyed the standard info an individual supply on your visitors? Is going to be again incessantly in order to check out new posts.

You have brought up a very excellent details, thankyou for the post.

I was reading some of your posts on this site and I believe this website is really instructive! Continue posting.

Just in such madness We should go on the prison So that the Prednestrovie at

It is appropriate time to make a few plans for the future and it is time to be happy. I have read this publish and if I could I desire to counsel you few fascinating issues or suggestions. Perhaps you can write subsequent articles regarding this article. I want to learn more things approximately it!

You dork the teenagers strength of us free than a

What about Go I adjusted to eat and not for your optimism When the famine So

No Did the dirt and meat better will be laid down trees nor even after you

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

We’re a gaggle of volunteers and opening a new scheme in our community. Your website provided us with useful info to work on. You’ve done an impressive job and our entire group will likely be thankful to you.

I truly appreciate this post. I’ve been looking all over for this! Thank goodness I found it on Bing. You have made my day! Thx again!

Thanks a bunch for sharing this with all of us you really know what you are talking about! Bookmarked. Kindly also visit my web site =). We could have a link exchange arrangement between us!

It is really a great and helpful piece of info. I am glad that you shared this helpful info with us. Please keep us informed like this. Thanks for sharing.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Heya! I’m at work browsing your blog from my new iphone 4! Just wanted to say I love reading through your blog and look forward to all your posts! Keep up the superb work!

I believe this internet site has got some really wonderful info for everyone. “Loving someone is easy but losing someone is hard.” by Shelby Harthcock.

Stop that thedogs are you but yet about to take

Your article helped me a lot, is there any more related content? Thanks!

Hi there, i read your blog from time to time and i own a similar one and i was just curious if you get a lot of spam responses? If so how do you stop it, any plugin or anything you can advise? I get so much lately it’s driving me insane so any help is very much appreciated.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Chechen campaign They have shot in soldier with the air and soil

I have learn some good stuff here. Certainly worth bookmarking for revisiting. I surprise how so much attempt you put to create any such magnificent informative web site.

Sporty rhythms! Score with Retro Bowl‘s musical gameplay!

Hello! Do you know if they make any plugins to safeguard against hackers? I’m kinda paranoid about losing everything I’ve worked hard on. Any suggestions?

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

xGrBc WGNONePw ZdOZpPDv

For strategic market entry, understanding local cultures and business practices is vital Iraq Business News provides context and background to help international businesses navigate these complexities

The report on regional developments in Iraq is particularly thorough at Iraq Business News, making it easier for businesses to identify growing markets and sectors of interest

BusinessIraq.com excels in monitoring technology and telecommunications developments shaping Iraq’s digital future. From e-commerce growth to digital transformation initiatives, our platform keeps stakeholders informed about emerging opportunities in Iraq’s evolving tech landscape.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

best darknet markets dark web link

dCKO cSGe XYDRhpT MrusidlA YmKAEEwC jjNqVJ IMMpu

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

dark web market links darknet links

dark market link dark websites

darknet drug market tor drug market

darknet market lists darknet drugs

dark web market darknet markets

dark web market links dark market 2025

dark web market urls dark web markets

onion dark website darknet markets links

darknet marketplace darkmarket

dark web drug marketplace dark web market

bitcoin dark web darknet sites

best darknet markets dark web sites

dark market darknet markets 2025

tor drug market darknet sites

darknet market dark web sites

dark markets 2025 darknet markets onion

dark web sites darknet markets links

dark market link dark markets

darknet markets url darkmarket

dark market link dark market onion

darknet site darknet markets url

dark market list darknet site

darknet drugs darknet drug store

bitcoin dark web darkmarket list

dark web drug marketplace darkmarket link

dark market url dark market 2025

darknet markets darknet markets onion

dark web marketplaces onion dark website

dark web market list darknet markets links

darknet markets links dark market onion

dark web market list dark web markets

darknet market dark web market links

dark web marketplaces darknet markets links

tor drug market darknet market links

tor drug market darkmarket 2025

dark websites dark web marketplaces

darknet markets onion dark web markets

darknet site darkmarkets

darknet drug store darkmarket link

dark web market urls darknet markets onion address

darknet markets dark web market list

darknet market lists dark web market

darknet market dark web market urls

dark web market list darkmarket link

darknet markets onion address onion dark website

dark websites tor drug market

dark web link dark web market list

darknet markets onion dark web market urls

dark web drug marketplace darknet market links

darknet sites darknet marketplace

dark market onion darknet markets links

darkmarket 2025 dark web sites

dark web drug marketplace darknet drug links

dark market link dark web market links

dark web drug marketplace dark markets 2025

darknet markets links dark web market list

onion dark website dark web market

darknet market darknet websites

darknet markets 2025 dark web sites

dark market list onion dark website

dark market dark market onion

dark web market urls dark web marketplaces

onion dark website darknet markets 2025

darkmarket 2025 darknet market links

darknet markets links tor drug market

bitcoin dark web dark web link

darkmarket list darknet markets onion

dark web market urls dark web markets

bitcoin dark web darkmarket link

darknet market links darkmarkets

dark web drug marketplace darknet markets links

dark market link dark web market urls

dark markets 2025 dark web market

dark market url darknet markets onion

darknet site darkmarkets

darkmarkets darknet market

best darknet markets darknet sites

darkmarket list darknet markets url

dark web link dark web market

darkmarket 2025 dark web drug marketplace

best darknet markets darkmarket url

darkmarket list darknet marketplace

dark market dark web market

dark market 2025 dark web market

dark web sites tor drug market

darknet links darknet market lists

darknet market list darknet markets onion

dark web drug marketplace darkmarket list

tor drug market dark web market links

darkmarket url darknet market links

darknet sites darknet marketplace

darknet market darknet drugs

dark web drug marketplace dark market onion

darknet markets url darkmarket list

darknet markets onion darkmarket list

darkmarkets best darknet markets

dark web market urls dark markets 2025

darkmarket url dark web drug marketplace

darknet links darknet markets url

I truly appreciate this post. I have been looking all over for this! Thank goodness I found it on Bing. You have made my day! Thank you again

darknet links bitcoin dark web

dark web drug marketplace dark websites

You made some respectable points there. I seemed on the web for the difficulty and found most individuals will go together with along with your website.

bitcoin dark web dark web market links

dark market url onion dark website

darknet market links darkmarket url

dark market link dark web sites

dark markets 2025 best darknet markets

darknet markets onion darknet markets url

bitcoin dark web darkmarket 2025

dark web marketplaces dark markets 2025

darknet markets 2025 darknet sites

bitcoin dark web dark websites

darknet drugs best darknet markets

tor drug market dark web markets

darknet markets onion address darknet market links

onion dark website darkmarket link

darknet sites darknet sites

darkmarket link darknet drug market

dark web sites dark market url

darknet markets links darknet drugs

dark web market urls darkmarket list

darknet marketplace darkmarket url

dark web link darkmarkets

darkmarket 2025 dark market url

darknet sites darknet market links

dark markets 2025 darknet site

darknet drug links darknet markets url

darknet market dark market onion

dark web sites dark web marketplaces

darknet drugs dark web marketplaces

darknet sites darknet markets links

dark markets dark web markets

darknet drug links darkmarket 2025

dark market onion darknet drugs

dark websites darknet marketplace

dark web link dark web market

dark web market links https://github.com/darknetmarketlistv8tg0/darknetmarketlist – onion dark website

darknet markets https://github.com/aresmarketlink0ru72/aresmarketlink – darkmarket

dark web markets https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl – onion dark website

darknet links https://github.com/tormarkets2025ukaz1/tormarkets2025 – dark web markets

darknet drug store https://github.com/darknetmarketlinks2025/darknetmarkets – dark web marketplaces

dark market https://github.com/aresmarketlink0ru72/aresmarketlink – darkmarket link

dark web link https://github.com/darknetmarketlistv8tg0/darknetmarketlist – darkmarket 2025

darknet market list https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl – dark web drug marketplace

dark websites https://github.com/tormarkets2025ukaz1/tormarkets2025 – dark web sites

dark market list https://github.com/aresmarketlink0ru72/aresmarketlink – darknet site

dark web market https://github.com/darknetmarketlinks2025/darknetmarkets – dark markets 2025

dark market list https://github.com/darknetmarketlistv8tg0/darknetmarketlist – best darknet markets

darknet drug store https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl – darknet market list

dark markets https://github.com/tormarkets2025ukaz1/tormarkets2025 – dark web market urls

dark market 2025 https://github.com/darknetmarketlinks2025/darknetmarkets – darknet drug links

darknet markets https://github.com/darknetmarketlistv8tg0/darknetmarketlist – dark web market links

darknet drug market https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl – darknet links

darkmarkets https://github.com/aresmarketlink0ru72/aresmarketlink – darknet markets onion address

darknet markets onion https://github.com/tormarkets2025ukaz1/tormarkets2025 – darknet market links

dark web market links https://github.com/darknetmarketlinks2025/darknetmarkets – dark web markets

darknet drug store https://github.com/darknetmarketlistv8tg0/darknetmarketlist – dark markets

dark market 2025 https://github.com/aresmarketlink0ru72/aresmarketlink – dark websites

dark web sites https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl – dark web marketplaces

darkmarket https://github.com/tormarkets2025ukaz1/tormarkets2025 – darknet site

darkmarket url https://github.com/darknetmarketlinks2025/darknetmarkets – dark web market list

dark web market urls https://github.com/aresmarketlink0ru72/aresmarketlink – dark web market links

dark websites https://github.com/darknetmarketlistv8tg0/darknetmarketlist – darknet site

best darknet markets https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl – darknet market lists

darkmarket list https://github.com/aresmarketlink0ru72/aresmarketlink – dark web market urls

dark web markets https://github.com/tormarkets2025ukaz1/tormarkets2025 – darkmarket 2025

best darknet markets https://github.com/darknetmarketlinks2025/darknetmarkets – darknet market links

dark market list https://github.com/darknetmarketlistv8tg0/darknetmarketlist – darkmarkets

darknet markets onion https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl – darknet websites

darkmarkets https://github.com/aresmarketlink0ru72/aresmarketlink – darknet site

darknet markets 2025 https://github.com/tormarkets2025ukaz1/tormarkets2025 – darknet market links

dark market url https://github.com/darknetmarketlinks2025/darknetmarkets – dark market link

dark web sites https://github.com/darknetmarketlistv8tg0/darknetmarketlist – darknet market lists

darknet drugs https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl – darknet drug market

darkmarket https://github.com/aresmarketlink0ru72/aresmarketlink – darkmarket link

darknet drug store https://github.com/tormarkets2025ukaz1/tormarkets2025 – darkmarket link

dark web marketplaces https://github.com/darknetmarketlinks2025/darknetmarkets – dark market 2025

darknet drug store https://github.com/aresmarketlink0ru72/aresmarketlink – darknet markets url

darknet websites https://github.com/darknetmarketlistv8tg0/darknetmarketlist – darknet site

dark market onion https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl – darknet marketplace

darknet markets url https://github.com/tormarkets2025ukaz1/tormarkets2025 – dark market 2025

darknet market links https://github.com/darknetmarketlinks2025/darknetmarkets – darknet market links

darknet markets onion address https://github.com/aresmarketlink0ru72/aresmarketlink – darknet websites

bitcoin dark web https://github.com/darknetmarketlistv8tg0/darknetmarketlist – darkmarket list

dark web market links https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl – dark web markets

darknet drug links https://github.com/aresmarketlink0ru72/aresmarketlink – darknet markets links

darknet markets https://github.com/tormarkets2025ukaz1/tormarkets2025 – dark web market urls

dark web link https://github.com/darknetmarketlinks2025/darknetmarkets – darknet markets

bitcoin dark web https://github.com/darknetmarketlistv8tg0/darknetmarketlist – darknet site

darknet markets onion address https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl – onion dark website

dark markets 2025 https://github.com/aresmarketlink0ru72/aresmarketlink – darknet market

dark web markets https://github.com/tormarkets2025ukaz1/tormarkets2025 – darknet websites

dark web market https://github.com/darknetmarketlinks2025/darknetmarkets – darkmarket link

onion dark website https://github.com/darknetmarketlistv8tg0/darknetmarketlist – dark markets 2025

darknet market https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl – darknet markets links

darknet market links https://github.com/aresmarketlink0ru72/aresmarketlink – dark web market urls

darknet market list https://github.com/tormarkets2025ukaz1/tormarkets2025 – dark web market links

darkmarket list https://github.com/darknetmarketlinks2025/darknetmarkets – dark market list

dark web sites https://github.com/aresmarketlink0ru72/aresmarketlink – darknet markets onion address

darknet websites https://github.com/darknetmarketlistv8tg0/darknetmarketlist – darkmarket 2025

darkmarkets https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl – dark web market

darknet sites https://github.com/tormarkets2025ukaz1/tormarkets2025 – dark web market

darknet drugs https://github.com/darknetmarketlinks2025/darknetmarkets – darknet market

darknet markets https://github.com/aresmarketlink0ru72/aresmarketlink – darknet market lists

dark market https://github.com/darknetmarketlistv8tg0/darknetmarketlist – dark websites

darknet market links https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl – darknet sites

darknet markets 2025 https://github.com/aresmarketlink0ru72/aresmarketlink – dark market 2025

dark web drug marketplace https://github.com/tormarkets2025ukaz1/tormarkets2025 – darkmarket url

dark market 2025 https://github.com/darknetmarketlinks2025/darknetmarkets – onion dark website

darkmarket link https://github.com/darknetmarketlistv8tg0/darknetmarketlist – dark web market urls

darknet markets onion https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl – onion dark website

dark web sites https://github.com/aresmarketlink0ru72/aresmarketlink – darknet websites

dark market link https://github.com/tormarkets2025ukaz1/tormarkets2025 – dark markets 2025

dark websites https://github.com/darknetmarketlinks2025/darknetmarkets – dark market 2025

darknet sites https://github.com/darknetmarketlistv8tg0/darknetmarketlist – darknet marketplace

tor drug market https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl – darknet links

darknet site https://github.com/aresmarketlink0ru72/aresmarketlink – darkmarket url

darknet marketplace https://github.com/tormarkets2025ukaz1/tormarkets2025 – darknet websites

darknet drug market https://github.com/darknetmarketlinks2025/darknetmarkets – bitcoin dark web

darknet markets 2025 https://github.com/aresmarketlink0ru72/aresmarketlink – darknet markets url

darknet drugs https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl – tor drug market

darknet markets onion https://github.com/tormarkets2025ukaz1/tormarkets2025 – dark market onion

darknet drug market https://github.com/darknetmarketlinks2025/darknetmarkets – dark web drug marketplace

dark web market urls https://github.com/aresmarketlink0ru72/aresmarketlink – darknet markets onion

darknet market links https://github.com/darknetmarketlistv8tg0/darknetmarketlist – darknet market links

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

dark web link https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl – darknet market links

darkmarket https://github.com/aresmarketlink0ru72/aresmarketlink – darkmarket 2025

onion dark website https://github.com/tormarkets2025ukaz1/tormarkets2025 – darknet drug store

onion dark website https://github.com/darknetmarketlinks2025/darknetmarkets – dark web market

darkmarket url https://github.com/darknetmarketlistv8tg0/darknetmarketlist – darknet markets links

dark market 2025 https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl – darkmarket url

bitcoin dark web https://github.com/aresmarketlink0ru72/aresmarketlink – dark web markets

dark web market https://github.com/tormarkets2025ukaz1/tormarkets2025 – darknet websites

dark markets https://github.com/darknetmarketlinks2025/darknetmarkets – dark web link

darknet sites https://github.com/darknetmarketlistv8tg0/darknetmarketlist – darknet markets onion address

dark web link https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl – darknet markets onion

best darknet markets https://github.com/aresmarketlink0ru72/aresmarketlink – dark web market

dark market url https://github.com/tormarkets2025ukaz1/tormarkets2025 – tor drug market

darknet markets https://github.com/darknetmarketlinks2025/darknetmarkets – dark market

darknet marketplace https://github.com/aresmarketlink0ru72/aresmarketlink – darkmarket

dark market list https://github.com/darknetmarketlistv8tg0/darknetmarketlist – dark web drug marketplace

dark market onion https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl – dark market 2025

darknet drug store https://github.com/tormarkets2025ukaz1/tormarkets2025 – darkmarket list

darknet markets onion address https://github.com/darknetmarketlinks2025/darknetmarkets – tor drug market

dark web drug marketplace https://github.com/aresmarketlink0ru72/aresmarketlink – dark web marketplaces

darkmarket https://github.com/darknetmarketlistv8tg0/darknetmarketlist – darknet markets links

darknet market links https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl – dark markets

dark web marketplaces https://github.com/aresmarketlink0ru72/aresmarketlink – darkmarket

dark market url https://github.com/tormarkets2025ukaz1/tormarkets2025 – dark web market

dark markets https://github.com/darknetmarketlinks2025/darknetmarkets – dark market url

darknet market https://github.com/darknetmarketlistv8tg0/darknetmarketlist – darkmarket url

darknet markets onion https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl – darknet links

darknet market links https://github.com/aresmarketlink0ru72/aresmarketlink – dark web drug marketplace

dark market list https://github.com/tormarkets2025ukaz1/tormarkets2025 – darknet markets 2025

darknet sites https://github.com/darknetmarketlinks2025/darknetmarkets – darknet market list

darknet drug market https://github.com/darknetmarketlistv8tg0/darknetmarketlist – onion dark website

dark market 2025 https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl – darknet markets links

darkmarket 2025 https://github.com/aresmarketlink0ru72/aresmarketlink – darknet websites

dark markets https://github.com/tormarkets2025ukaz1/tormarkets2025 – darknet marketplace

darknet markets links https://github.com/darknetmarketlinks2025/darknetmarkets – darknet sites

darknet sites https://github.com/aresmarketlink0ru72/aresmarketlink – darknet market links

darkmarket https://github.com/darknetmarketlistv8tg0/darknetmarketlist – onion dark website

darkmarkets https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl – darknet markets onion

dark web markets https://github.com/tormarkets2025ukaz1/tormarkets2025 – darkmarket

darknet site https://github.com/darknetmarketlinks2025/darknetmarkets – dark market link

tor drug market https://github.com/aresmarketlink0ru72/aresmarketlink – dark web market urls

darknet sites https://github.com/darknetmarketlistv8tg0/darknetmarketlist – darknet site

darkmarket https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl – dark markets 2025

darknet markets onion address https://github.com/aresmarketlink0ru72/aresmarketlink – dark web sites

darknet marketplace https://github.com/tormarkets2025ukaz1/tormarkets2025 – dark web market list

dark web market https://github.com/darknetmarketlinks2025/darknetmarkets – onion dark website

dark markets https://github.com/darknetmarketlistv8tg0/darknetmarketlist – darknet market lists

darknet websites https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl – dark market url

darknet market lists https://github.com/aresmarketlink0ru72/aresmarketlink – dark market onion

darknet drug store https://github.com/tormarkets2025ukaz1/tormarkets2025 – darknet markets 2025

dark web market links https://github.com/darknetmarketlinks2025/darknetmarkets – darknet markets url

darknet site https://github.com/darknetmarketlistv8tg0/darknetmarketlist – dark websites

darkmarket url https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl – darknet site

darknet market list https://github.com/aresmarketlink0ru72/aresmarketlink – dark market 2025

darknet markets url https://github.com/darknetmarketlinks2025/darknetmarkets – darknet drug links

bitcoin dark web https://github.com/aresmarketlink0ru72/aresmarketlink – darknet markets links

darkmarket link https://github.com/darknetmarketlistv8tg0/darknetmarketlist – darknet markets 2025

darknet drug links https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl – dark market

darknet markets 2025 https://github.com/darknetmarketlinks2025/darknetmarkets – darknet drug market

dark market 2025 https://github.com/tormarkets2025ukaz1/tormarkets2025 – darknet markets url

darknet drugs https://github.com/aresmarketlink0ru72/aresmarketlink – dark markets 2025

darkmarket url https://github.com/darknetmarketlistv8tg0/darknetmarketlist – onion dark website

dark web market https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl – darkmarket 2025

darknet market lists https://github.com/aresmarketlink0ru72/aresmarketlink – onion dark website

dark markets 2025 https://github.com/darknetmarketlinks2025/darknetmarkets – darknet market links

dark web market https://github.com/darknetmarketlistv8tg0/darknetmarketlist – darknet site

dark web markets https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl – darknet links

darknet drug market https://github.com/aresmarketlink0ru72/aresmarketlink – darknet sites

dark market 2025 https://github.com/tormarkets2025ukaz1/tormarkets2025 – dark web markets

dark websites https://github.com/darknetmarketlistv8tg0/darknetmarketlist – dark market url

darknet markets links https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl – tor drug market

dark web sites https://github.com/tormarkets2025ukaz1/tormarkets2025 – dark market list

darknet market https://github.com/aresmarketlink0ru72/aresmarketlink – darkmarket list

darkmarket url https://github.com/darknetmarketlistv8tg0/darknetmarketlist – darkmarket url

darknet drug market https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl – darknet markets onion address

darkmarket list https://github.com/darknetmarketlinks2025/darknetmarkets – dark web market links

darkmarkets https://github.com/aresmarketlink0ru72/aresmarketlink – darkmarket

darknet market https://github.com/darknetmarketlistv8tg0/darknetmarketlist – darknet site

darknet market links https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl – darknet drug store

darkmarkets https://github.com/tormarkets2025ukaz1/tormarkets2025 – dark web market urls

darknet marketplace https://github.com/aresmarketlink0ru72/aresmarketlink – onion dark website

dark websites https://github.com/darknetmarketlistv8tg0/darknetmarketlist – bitcoin dark web

dark market 2025 https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl – dark web market links

dark market onion https://github.com/aresmarketlink0ru72/aresmarketlink – dark market link

dark market 2025 https://github.com/darknetmarketlinks2025/darknetmarkets – dark market list

dark websites https://github.com/darknetmarketlistv8tg0/darknetmarketlist – dark web market links

dark market list https://github.com/aresmarketlink0ru72/aresmarketlink – dark web markets

darkmarkets https://github.com/darknetmarketlinks2025/darknetmarkets – dark market url

dark web market urls https://github.com/aresmarketlink0ru72/aresmarketlink – best darknet markets

dark market url https://github.com/darknetmarketlistv8tg0/darknetmarketlist – darkmarket list

dark market url https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl – darkmarket

darkmarket url https://github.com/darknetmarketlinks2025/darknetmarkets – darknet marketplace

best darknet markets https://github.com/aresmarketlink0ru72/aresmarketlink – dark market onion

dark web link https://github.com/darknetmarketlistv8tg0/darknetmarketlist – dark market 2025

dark market link https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl – darkmarket 2025

darknet drug market https://github.com/darknetmarketlinks2025/darknetmarkets – darknet markets url

darknet market list https://github.com/aresmarketlink0ru72/aresmarketlink – darknet drug links

dark web market urls https://github.com/darknetmarketlistv8tg0/darknetmarketlist – dark web market links

darkmarket link https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl – darknet drug store

dark web market list https://github.com/aresmarketlink0ru72/aresmarketlink – best darknet markets

darknet sites https://github.com/darknetmarketlinks2025/darknetmarkets – dark markets 2025

darknet markets onion https://github.com/tormarkets2025ukaz1/tormarkets2025 – darknet drug market

dark web market list https://github.com/darknetmarketlistv8tg0/darknetmarketlist – dark web market

dark web market urls https://github.com/aresmarketlink0ru72/aresmarketlink – darknet market lists

darkmarket link https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl – dark market link

darknet market https://github.com/tormarkets2025ukaz1/tormarkets2025 – darkmarket 2025

dark market 2025 https://github.com/aresmarketlink0ru72/aresmarketlink – dark web market list

dark web market https://github.com/darknetmarketlistv8tg0/darknetmarketlist – darknet market

darknet markets url https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl – darknet drugs

darkmarket list https://github.com/tormarkets2025ukaz1/tormarkets2025 – darknet markets

darkmarkets https://github.com/aresmarketlink0ru72/aresmarketlink – dark web market

darkmarket link https://github.com/darknetmarketlistv8tg0/darknetmarketlist – dark market list

darknet drug store https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl – darknet markets

darknet markets onion address https://github.com/darknetmarketlinks2025/darknetmarkets – dark web sites

darkmarket url https://github.com/aresmarketlink0ru72/aresmarketlink – dark market url

darkmarkets https://github.com/darknetmarketlistv8tg0/darknetmarketlist – darknet drug store

darknet links https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl – dark web markets

darknet markets https://github.com/aresmarketlink0ru72/aresmarketlink – darknet market

darknet markets onion address https://github.com/tormarkets2025ukaz1/tormarkets2025 – dark web market urls

darknet drug links https://github.com/darknetmarketlistv8tg0/darknetmarketlist – dark web marketplaces

darkmarket 2025 https://github.com/aresmarketlink0ru72/aresmarketlink – darkmarket link

darkmarket url https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl – best darknet markets

darknet site https://github.com/darknetmarketlinks2025/darknetmarkets – dark markets

darknet markets 2025 https://github.com/aresmarketlink0ru72/aresmarketlink – onion dark website

darkmarket list https://github.com/darknetmarketlistv8tg0/darknetmarketlist – dark web market urls

darknet markets 2025 https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl – dark web link

darknet markets links https://github.com/tormarkets2025ukaz1/tormarkets2025 – tor drug market

dark market 2025 https://github.com/aresmarketlink0ru72/aresmarketlink – darkmarket url

darknet drug market https://github.com/darknetmarketlistv8tg0/darknetmarketlist – darknet markets onion address

dark websites https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl – darknet markets

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me? https://accounts.binance.com/ES_la/register?ref=T7KCZASX

dark web link https://github.com/tormarkets2025ukaz1/tormarkets2025 – dark web market links

darknet market https://github.com/darknetmarketlinks2025/darknetmarkets – darknet marketplace

darkmarket list https://github.com/aresmarketlink0ru72/aresmarketlink – dark markets

darknet markets onion address https://github.com/darknetmarketlistv8tg0/darknetmarketlist – darknet websites

darknet markets links https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl – bitcoin dark web

bitcoin dark web https://github.com/tormarkets2025ukaz1/tormarkets2025 – darknet markets url

dark web market links https://github.com/aresmarketlink0ru72/aresmarketlink – dark web drug marketplace

darknet sites https://github.com/darknetmarketlistv8tg0/darknetmarketlist – darkmarkets

dark market onion https://github.com/aresmarketlink0ru72/aresmarketlink – darkmarket url

dark web drug marketplace https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl – darknet market list

darknet drug links https://github.com/darknetmarketlinks2025/darknetmarkets – darknet markets onion

darkmarket url https://github.com/darknetmarketlistv8tg0/darknetmarketlist – darknet market links

dark web drug marketplace https://github.com/aresmarketlink0ru72/aresmarketlink – onion dark website

darknet drugs https://github.com/nexusdarkneturlwrf4t/nexusdarkneturl – dark web link

dark markets https://github.com/tormarkets2025ukaz1/tormarkets2025 – darknet markets

dark market list https://github.com/aresmarketlink0ru72/aresmarketlink – onion dark website

tor drug market darknet marketplace

darknet market lists darknet drug market

darknet markets links tor drug market

dark web market urls darknet market

dark web market links darknet market list

dark web market urls darknet drugs

dark market onion dark websites

darknet drug store dark market 2025

darknet drug store darknet marketplace

darknet marketplace dark web link

darknet links dark web link

darkmarket url dark markets

darknet market links dark web markets

dark websites darknet drug market

dark market list dark web link

darknet drug links darknet market lists

darkmarket list darknet markets links

dark markets 2025 dark web market links

dark web market links darknet market list

tor drug market darknet markets links

darkmarket 2025 tor drug market

darknet markets 2025 darkmarket url

dark web drug marketplace darknet site

darknet market lists darknet market list

darknet markets onion address dark web link

dark market onion darknet sites

tor drug market dark web markets

darknet markets url dark markets 2025

darknet markets 2025 darknet drug market

dark market link best darknet markets

darkmarkets dark market

dark market link darkmarket url

dark web market list darknet drugs

darknet drug market darkmarket link

darknet markets 2025 darknet markets

darknet drugs darknet market links

dark markets 2025 darknet websites

dark web market darknet links

darknet markets onion address darknet markets 2025

dark web market darknet websites

dark market 2025 darkmarket 2025

darknet site bitcoin dark web

darknet markets onion tor drug market

dark web market list darkmarket list

dark market list darknet drug market

dark web link darknet drug links

darknet markets dark web marketplaces

dark web markets darknet drugs

dark web marketplaces darknet drugs

darknet drug market dark web market

darknet websites dark markets

darknet markets onion dark web sites

dark market link darkmarket 2025

darknet markets onion darknet sites

darknet markets 2025 dark markets 2025

onion dark website darkmarket list

darknet drug market dark markets 2025

darkmarket link darknet market

darknet markets links dark markets

darknet markets darkmarket list

darknet site dark web market urls

dark web markets darknet marketplace

dark market list darkmarkets

darkmarket link darknet markets onion

dark markets 2025 darkmarket

onion dark website darknet market lists

darknet sites darknet market list

darknet drug links darknet websites

darkmarket link dark market 2025

darknet drug market darkmarkets

darknet drug links onion dark website

tor drug market darknet websites

darknet websites darkmarket url

dark web drug marketplace dark market list

best darknet markets darknet websites

darknet marketplace dark web market urls

dark market url dark web marketplaces

darknet market darknet drug store

dark market 2025 darknet drugs

darknet markets darkmarket link

darknet markets url darknet markets onion address

dark markets dark market 2025

darkmarket url dark markets 2025

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

darknet marketplace darknet markets onion address

dark web market list darknet market list

darkmarket url dark markets

dark market list darknet market links

darknet market list darknet market

dark markets 2025 darknet drug market

dark web link dark web link

dark web market dark markets 2025

darknet drugs bitcoin dark web

darkmarket darknet sites

darknet markets dark web market

darkmarket dark web market links

dark web sites darknet market

dark web marketplaces darknet markets url

dark markets 2025 darknet markets

darkmarket url dark market onion

onion dark website darkmarket url

dark web link dark web markets

dark web marketplaces darknet markets

darknet markets onion address darknet links

darkmarket url dark web sites

darknet market darknet markets

dark web marketplaces darkmarket 2025

bitcoin dark web darknet site

darkmarket darknet markets url

darknet marketplace darkmarket link

darknet sites dark web market

darknet drug store darkmarket list

dark market darkmarket

dark web drug marketplace dark market 2025

dark market darknet drug links

darkmarket url darknet markets

dark market url darknet marketplace

darkmarkets darknet drug market

darkmarket 2025 dark web market links

darknet markets links dark market 2025

dark web market list dark markets 2025

dark web drug marketplace bitcoin dark web

dark web market urls dark market url

dark web link darknet market

dark web sites darknet drug market

darkmarkets dark markets 2025

dark web drug marketplace dark web market urls

darknet sites darknet links

dark market dark websites

dark market dark markets 2025

darknet drug store darknet drug links

dark web market list onion dark website

dark market link dark market url

onion dark website darknet market links

darknet market lists darknet markets onion address

darknet markets onion address dark web drug marketplace

darknet marketplace dark web market list

dark web market urls darkmarket url

onion dark website onion dark website

darknet markets links darknet drug market

dark market list darkmarket

darknet markets url darknet markets onion address

dark market tor drug market

darkmarket url darknet markets links

dark web market list darknet markets onion address

darkmarket list darknet market

dark web market list dark web market urls

darknet market dark web market links

darkmarket link darknet drug links

darknet markets onion address dark markets 2025

darknet drug links dark web market list

dark web market list darknet market lists

darknet market lists darknet drug links

darknet market tor drug market

darknet market lists dark web link

darknet sites dark markets

dark market onion dark web market links

darknet markets darknet markets links

dark markets dark web marketplaces

darknet market links darknet markets onion address

darknet websites darknet links

darknet drug links darknet site

darknet markets 2025 dark websites

bitcoin dark web darkmarket 2025

dark market dark market 2025

darkmarket url darknet websites

dark web market urls darknet market

darknet market list dark markets

darkmarkets dark web market links

best darknet markets darknet marketplace

dark market list onion dark website

darkmarket link darkmarket

darknet markets links dark websites

dark market onion dark web market urls

dark websites darkmarket url

darknet markets links darknet marketplace

darkmarkets darknet market

darkmarket list dark web marketplaces

best darknet markets darknet markets links

darknet drugs darkmarket link

darkmarket tor drug market

best darknet markets onion dark website

darknet markets onion dark web link

darkmarket link dark web market links

darknet markets links dark web market urls

tor drug market darknet sites

darknet marketplace darkmarket 2025

darkmarkets darkmarket list

darknet websites dark web markets

darknet markets links darknet marketplace

dark market link darknet market list

darknet market links dark markets

darknet markets onion address dark web markets

darknet markets 2025 darknet websites

tor drug market dark web link

dark websites dark markets 2025

dark web market list darkmarkets

darknet drug links darkmarket

dark market darkmarket

darknet drugs dark web drug marketplace

dark web marketplaces darknet links

dark web market list dark market onion

darknet market darkmarket

darknet links darknet market links

dark web market list dark market 2025

dark market dark markets 2025

dark web link darknet links

darkmarket list tor drug market

darknet markets 2025 darknet markets links

dark websites dark market 2025

dark web sites dark market url

darknet markets url dark markets 2025

dark web markets darknet websites

darknet drugs dark web market

dark market onion dark web market list

darknet websites dark web market links

darknet links dark web markets

darkmarket darknet markets url

darknet markets url darkmarket list

darknet market links darknet markets url

darkmarket dark market onion

darkmarket 2025 onion dark website

bitcoin dark web darknet websites

darkmarkets darknet markets url

darkmarket 2025 darkmarket 2025

darknet markets dark market onion

darknet links dark market onion

onion dark website dark web sites

darknet markets url dark web link

dark web market links bitcoin dark web

darknet market links darknet markets url

darknet market lists darkmarket list

dark web sites dark web market urls

darknet marketplace dark websites

darkmarket list best darknet markets

darknet markets 2025 darknet markets url

darknet markets 2025 dark market 2025

tor drug market dark market url

darkmarket link darkmarket 2025

dark web market list darknet markets

darknet market darknet markets url

darknet drug store dark market url

dark market list dark markets

darknet market list dark web markets

darknet marketplace darknet market

dark websites dark websites

dark markets 2025 dark web marketplaces

darkmarket 2025 dark markets

darknet market links darknet drug links

best darknet markets darknet sites

darknet markets 2025 darknet links

darknet drugs dark market onion

darknet markets onion darknet drug store

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

dark web market links darkmarket link

darknet markets darknet markets

dark market 2025 onion dark website

darknet links darknet markets onion

darkmarkets darkmarket list

dark web market darknet markets url

darknet market links darknet websites

darkmarket link darknet market list

darknet markets 2025 darkmarket url

dark market link darknet markets

darkmarkets onion dark website

My brother suggested I might like this web site. He was totally right. This post truly made my day. You can not imagine just how much time I had spent for this info! Thanks!

darkmarket link darknet markets onion address

dark web market links dark market 2025

darknet drug store darknet websites

dark web market links darknet links

darknet market list darknet websites

darkmarket link dark market

dark web markets dark web markets

darknet site darknet market list

dark web market urls dark web drug marketplace

dark market 2025 dark web market links

darknet market lists tor drug market

darknet markets darknet site

darknet markets onion address dark market url

dark market link dark market url

darkmarket list dark market link

dark market list darknet market

dark market url dark web market links

darkmarket 2025 dark web market urls

onion dark website darknet market lists

darknet drug links dark market url

darknet sites dark web market

bitcoin dark web dark market url

darknet market dark markets 2025

dark market url darknet markets links

dark web drug marketplace dark web market urls

darknet websites bitcoin dark web

dark web sites tor drug market

darknet market lists bitcoin dark web

onion dark website darknet market links

dark market link dark market link

dark market 2025 darknet site

darknet markets dark market list

Purdentix reviews

dark web market list darknet market links

Purdentix

dark market onion darknet markets url

darknet drug store darknet market list

Purdentix

darknet site darknet drug market

darknet market lists dark market onion

Purdentix reviews

Purdentix review

darknet drug store dark web drug marketplace

darknet sites darkmarket list

Purdentix review

dark web market darknet drug store

tor drug market darknet drug store

Purdentix

dark markets 2025 https://github.com/darkwebmarketslinks/darkwebmarkets darknet market links

darknet links https://github.com/darknetmarketslist/darknetmarketslist darknet markets

darknet markets 2025 https://github.com/darknetmarkets2025/darknetmarketlinks darknet websites

I love how user-friendly and intuitive everything feels.

darknet drug links https://github.com/darkwebwebsites/darkwebwebsites darknet site

The content is well-organized and highly informative.

darknet drugs https://github.com/darknetmarketlinks2025/darknetmarkets darkmarkets

darknet sites https://github.com/darkwebmarketslinks/darkwebmarkets darkmarket url

darknet drug links https://github.com/darknetmarkets2025/darknetmarketlinks darkmarket link

onion dark website https://github.com/darknetmarketslist/darknetmarketslist darkmarkets

dark market onion https://github.com/darkwebwebsites/darkwebwebsites dark market

dark market onion https://github.com/darknetmarkets2025/darknetmarketlinks darkmarket

darkmarket https://github.com/darknetmarketlinks2025/darknetmarkets dark market 2025

darknet sites https://github.com/darkwebmarketslinks/darkwebmarkets darknet marketplace

darkmarket 2025 https://github.com/darknetmarketslist/darknetmarketslist darknet drug market

dark market list https://github.com/darkwebwebsites/darkwebwebsites dark web market urls

dark markets https://github.com/darknetmarkets2025/darknetmarketlinks dark markets 2025

darknet marketplace https://github.com/darknetmarketlinks2025/darknetmarkets darknet drug links

darknet drug market https://github.com/darkwebmarketslinks/darkwebmarkets darkmarket 2025

dark web sites https://github.com/darknetmarketslist/darknetmarketslist darkmarket

dark market https://github.com/darknetmarkets2025/darknetmarketlinks darknet site

bitcoin dark web https://github.com/darkwebwebsites/darkwebwebsites darknet marketplace

dark web marketplaces https://github.com/darknetmarketlinks2025/darknetmarkets darknet markets 2025

dark web sites https://github.com/darkwebmarketslinks/darkwebmarkets dark web link

best darknet markets https://github.com/darknetmarketslist/darknetmarketslist dark market

dark market list https://github.com/darknetmarkets2025/darknetmarketlinks darknet links

darkmarkets https://github.com/darkwebwebsites/darkwebwebsites dark websites

dark market 2025 https://github.com/darknetmarketlinks2025/darknetmarkets best darknet markets

darknet sites https://github.com/darkwebmarketslinks/darkwebmarkets dark web drug marketplace

darknet drug store https://github.com/darknetmarkets2025/darknetmarketlinks darknet market list

darknet drugs https://github.com/darknetmarketslist/darknetmarketslist dark market url

darkmarket url https://github.com/darkwebwebsites/darkwebwebsites dark market link

darknet market https://github.com/darknetmarkets2025/darknetmarketlinks best darknet markets

darkmarket link https://github.com/darknetmarketlinks2025/darknetmarkets darknet markets

dark web markets https://github.com/darkwebmarketslinks/darkwebmarkets dark market onion

dark web markets https://github.com/darknetmarketslist/darknetmarketslist dark web sites

The layout is visually appealing and very functional.

The content is engaging and well-structured, keeping visitors interested.

darkmarket https://github.com/darkwebwebsites/darkwebwebsites dark web marketplaces

dark market url https://github.com/darknetmarkets2025/darknetmarketlinks dark web market urls

The layout is visually appealing and very functional.

darknet site https://github.com/darknetmarketlinks2025/darknetmarkets dark markets 2025

dark market url https://github.com/darkwebmarketslinks/darkwebmarkets dark web marketplaces

The design and usability are top-notch, making everything flow smoothly.

darknet drug market https://github.com/darknetmarketslist/darknetmarketslist dark market

darknet marketplace https://github.com/darknetmarkets2025/darknetmarketlinks darknet market lists

I love how user-friendly and intuitive everything feels.

dark websites https://github.com/darkwebwebsites/darkwebwebsites dark web link

It provides an excellent user experience from start to finish.

darknet site https://github.com/darknetmarketlinks2025/darknetmarkets darknet markets 2025

darknet market lists https://github.com/darkwebmarketslinks/darkwebmarkets darknet sites

darknet websites https://github.com/darknetmarketslist/darknetmarketslist darknet market

darkmarket url https://github.com/darknetmarkets2025/darknetmarketlinks darkmarket

This site truly stands out as a great example of quality web design and performance.

A perfect blend of aesthetics and functionality makes browsing a pleasure.

darknet markets https://github.com/darkwebwebsites/darkwebwebsites darknet markets 2025

The content is engaging and well-structured, keeping visitors interested.

darknet market links https://github.com/darkwebmarketslinks/darkwebmarkets dark web market urls

darknet market https://github.com/darknetmarkets2025/darknetmarketlinks dark market 2025

This website is amazing, with a clean design and easy navigation.

darknet drugs https://github.com/darknetmarketslist/darknetmarketslist darkmarket

I love how user-friendly and intuitive everything feels.

onion dark website https://github.com/darkwebwebsites/darkwebwebsites darknet links

The design and usability are top-notch, making everything flow smoothly.

dark web drug marketplace https://github.com/darknetmarkets2025/darknetmarketlinks darkmarket list

The content is well-organized and highly informative.

darknet marketplace https://github.com/darkwebmarketslinks/darkwebmarkets darkmarket

darknet drug store https://github.com/darknetmarketslist/darknetmarketslist darknet market links

The design and usability are top-notch, making everything flow smoothly.

darknet marketplace https://github.com/darkwebwebsites/darkwebwebsites dark web marketplaces

darknet market lists https://github.com/darknetmarkets2025/darknetmarketlinks darkmarket

The layout is visually appealing and very functional.

darknet market links https://github.com/darkwebmarketslinks/darkwebmarkets darknet site

darknet links https://github.com/darknetmarketslist/darknetmarketslist darknet drug store

darknet market lists https://github.com/darknetmarkets2025/darknetmarketlinks dark web markets

darknet drug store https://github.com/darkwebwebsites/darkwebwebsites dark web sites

dark markets 2025 https://github.com/darkwebmarketslinks/darkwebmarkets dark markets 2025

dark market url https://github.com/darknetmarketslist/darknetmarketslist dark market url

darknet markets onion address https://github.com/darknetmarkets2025/darknetmarketlinks darknet marketplace

best darknet markets https://github.com/darkwebwebsites/darkwebwebsites dark web drug marketplace

dark web markets https://github.com/darkwebmarketslinks/darkwebmarkets darknet drug store

dark web marketplaces https://github.com/darknetmarkets2025/darknetmarketlinks darknet market links

darknet markets onion https://github.com/darknetmarketslist/darknetmarketslist dark market url

darknet drug store https://github.com/darkwebwebsites/darkwebwebsites dark market onion

dark web marketplaces https://github.com/darknetmarkets2025/darknetmarketlinks darknet market list

best darknet markets https://github.com/darkwebmarketslinks/darkwebmarkets dark web markets

darknet markets https://github.com/darknetmarketslist/darknetmarketslist onion dark website

dark websites https://github.com/darkwebwebsites/darkwebwebsites darknet sites

darknet markets https://github.com/darknetmarkets2025/darknetmarketlinks darknet markets url

dark market https://github.com/darkwebmarketslinks/darkwebmarkets darkmarket url

dark web drug marketplace https://github.com/darknetmarketslist/darknetmarketslist darknet marketplace

dark markets https://github.com/darknetmarkets2025/darknetmarketlinks darkmarkets

darknet marketplace https://github.com/darkwebwebsites/darkwebwebsites darkmarket 2025

dark markets 2025 https://github.com/darkwebmarketslinks/darkwebmarkets darknet drug links

darknet site https://github.com/darknetmarketslist/darknetmarketslist dark web markets

dark markets https://github.com/darknetmarkets2025/darknetmarketlinks darknet markets onion address

darknet markets onion address https://github.com/darkwebwebsites/darkwebwebsites darknet websites

darknet marketplace https://github.com/darkwebmarketslinks/darkwebmarkets darkmarket url

dark websites https://github.com/darknetmarkets2025/darknetmarketlinks dark markets 2025

darkmarket 2025 https://github.com/darknetmarketslist/darknetmarketslist bitcoin dark web

darkmarkets https://github.com/darkwebwebsites/darkwebwebsites darknet marketplace

darknet markets onion https://github.com/darknetmarkets2025/darknetmarketlinks darknet markets 2025

darkmarket link https://github.com/darkwebmarketslinks/darkwebmarkets dark web market links

The content is engaging and well-structured, keeping visitors interested.

dark web drug marketplace https://github.com/darknetmarketslist/darknetmarketslist dark websites

I’m really impressed by the speed and responsiveness.

dark web market links https://github.com/darkwebwebsites/darkwebwebsites dark market link

A perfect blend of aesthetics and functionality makes browsing a pleasure.

darknet markets 2025 https://github.com/darknetmarkets2025/darknetmarketlinks dark web drug marketplace

This website is amazing, with a clean design and easy navigation.

dark market link https://github.com/darkwebmarketslinks/darkwebmarkets dark web markets

darknet sites https://github.com/darknetmarketslist/darknetmarketslist darkmarket link

The content is well-organized and highly informative.

The layout is visually appealing and very functional.

darkmarket 2025 https://github.com/darknetmarkets2025/darknetmarketlinks dark web market

The content is well-organized and highly informative.

darknet drug store https://github.com/darkwebwebsites/darkwebwebsites darknet markets url

darkmarket url https://github.com/darkwebmarketslinks/darkwebmarkets darkmarket url

dark market link https://github.com/darknetmarketslist/darknetmarketslist darknet websites

AQUA SCULPT

It provides an excellent user experience from start to finish.

dark market https://github.com/darknetmarkets2025/darknetmarketlinks darknet links

dark market 2025 https://github.com/darkwebwebsites/darkwebwebsites tor drug market

I love how user-friendly and intuitive everything feels.

dark web marketplaces https://github.com/darkwebmarketslinks/darkwebmarkets darknet site

darknet drug store https://github.com/darknetmarkets2025/darknetmarketlinks onion dark website

darknet links https://github.com/darknetmarketslist/darknetmarketslist darknet market links

dark market link https://github.com/darkwebwebsites/darkwebwebsites darknet markets 2025

The design and usability are top-notch, making everything flow smoothly.

I’m really impressed by the speed and responsiveness.

darknet drug links https://github.com/darknetmarkets2025/darknetmarketlinks onion dark website

darknet site https://github.com/darkwebmarketslinks/darkwebmarkets darkmarkets

dark market list https://github.com/darknetmarketslist/darknetmarketslist darknet markets 2025

darkmarket list https://github.com/darkwebwebsites/darkwebwebsites darkmarket 2025

dark market onion https://github.com/darknetmarkets2025/darknetmarketlinks dark market

This site truly stands out as a great example of quality web design and performance.

dark web market links https://github.com/darkwebmarketslinks/darkwebmarkets darknet market list

I love how user-friendly and intuitive everything feels.

darkmarket https://github.com/darknetmarketslist/darknetmarketslist dark market list

I’m really impressed by the speed and responsiveness.

darkmarket 2025 https://github.com/darknetmarkets2025/darknetmarketlinks darknet sites

The design and usability are top-notch, making everything flow smoothly.

bitcoin dark web https://github.com/darkwebwebsites/darkwebwebsites dark market

The content is well-organized and highly informative.

darknet marketplace https://github.com/darkwebmarketslinks/darkwebmarkets dark market 2025

The content is engaging and well-structured, keeping visitors interested.

dark market 2025 https://github.com/darknetmarketslist/darknetmarketslist best darknet markets

darknet drugs https://github.com/darknetmarkets2025/darknetmarketlinks dark market link

darknet markets links https://github.com/darknetmarketlinks2025/darknetmarkets darkmarket url

This site truly stands out as a great example of quality web design and performance.

dark web market https://github.com/darkwebmarketslinks/darkwebmarkets dark market 2025

darknet drugs https://github.com/darknetmarkets2025/darknetmarketlinks dark web sites

dark market url https://github.com/darknetmarketslist/darknetmarketslist dark market link

The layout is visually appealing and very functional.

dark web market urls https://github.com/darknetmarketlinks2025/darknetmarkets darknet sites

The layout is visually appealing and very functional.

darknet market list https://github.com/darkwebwebsites/darkwebwebsites dark web market urls

The design and usability are top-notch, making everything flow smoothly.

darkmarkets https://github.com/darknetmarkets2025/darknetmarketlinks bitcoin dark web

darknet market list https://github.com/darkwebmarketslinks/darkwebmarkets dark web market list

dark web market links https://github.com/darknetmarketslist/darknetmarketslist darknet market lists

I love how user-friendly and intuitive everything feels.

darknet websites https://github.com/darknetmarketlinks2025/darknetmarkets dark market onion

darknet drugs https://github.com/darkwebwebsites/darkwebwebsites darknet markets

darknet websites https://github.com/darknetmarkets2025/darknetmarketlinks dark web markets

dark websites https://github.com/darkwebmarketslinks/darkwebmarkets darknet market

dark websites https://github.com/darknetmarketslist/darknetmarketslist dark market

darknet markets url https://github.com/darknetmarketlinks2025/darknetmarkets dark web market list

darknet market links https://github.com/darknetmarkets2025/darknetmarketlinks darkmarket list

darkmarkets https://github.com/darkwebwebsites/darkwebwebsites dark market 2025

dark markets 2025 https://github.com/darkwebmarketslinks/darkwebmarkets darknet drug store

dark market list https://github.com/darknetmarketslist/darknetmarketslist darknet websites

dark web market https://github.com/darknetmarkets2025/darknetmarketlinks darknet marketplace

darkmarket 2025 https://github.com/darknetmarketlinks2025/darknetmarkets darknet site

darknet markets onion https://github.com/darkwebwebsites/darkwebwebsites darknet drugs

dark market 2025 https://github.com/darkwebmarketslinks/darkwebmarkets dark web market links

dark market onion https://github.com/darknetmarkets2025/darknetmarketlinks dark web drug marketplace

I’m really impressed by the speed and responsiveness.

darknet markets onion https://github.com/darknetmarketslist/darknetmarketslist darkmarket 2025

It provides an excellent user experience from start to finish.

darknet websites https://github.com/darknetmarketlinks2025/darknetmarkets dark market

The content is well-organized and highly informative.

darknet drug market https://github.com/darkwebwebsites/darkwebwebsites dark market

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

The design and usability are top-notch, making everything flow smoothly.

dark market url https://github.com/darknetmarkets2025/darknetmarketlinks darknet markets links

dark market 2025 https://github.com/darkwebmarketslinks/darkwebmarkets dark market onion

darknet markets 2025 https://github.com/darknetmarketslist/darknetmarketslist darknet markets 2025

This site truly stands out as a great example of quality web design and performance.

dark market list https://github.com/darknetmarketlinks2025/darknetmarkets dark web marketplaces

dark market list https://github.com/darkwebwebsites/darkwebwebsites dark web markets

The content is well-organized and highly informative.

dark market list https://github.com/darknetmarkets2025/darknetmarketlinks darkmarket link

It provides an excellent user experience from start to finish.

dark web sites https://github.com/darkwebmarketslinks/darkwebmarkets dark web sites

dark web market links https://github.com/darknetmarketslist/darknetmarketslist dark market url

darknet websites https://github.com/darknetmarketlinks2025/darknetmarkets dark web markets

darknet markets links https://github.com/darknetmarkets2025/darknetmarketlinks darknet links

dark web market list https://github.com/darkwebwebsites/darkwebwebsites dark markets 2025

darknet markets https://github.com/darkwebmarketslinks/darkwebmarkets darknet drug market

darkmarket 2025 https://github.com/darknetmarketslist/darknetmarketslist dark web drug marketplace

dark web market urls https://github.com/darknetmarkets2025/darknetmarketlinks darknet market lists

darknet drug links https://github.com/darknetmarketlinks2025/darknetmarkets dark web market

darknet drug links https://github.com/darkwebwebsites/darkwebwebsites dark markets 2025

The design and usability are top-notch, making everything flow smoothly.

darknet drug links https://github.com/darkwebmarketslinks/darkwebmarkets dark market onion

dark market 2025 https://github.com/darknetmarkets2025/darknetmarketlinks darknet drug market

dark market list https://github.com/darknetmarketslist/darknetmarketslist darknet markets onion

dark web marketplaces https://github.com/darknetmarketlinks2025/darknetmarkets bitcoin dark web

ICE HACK

darknet websites https://github.com/darkwebwebsites/darkwebwebsites darkmarket url

dark market https://github.com/darknetmarkets2025/darknetmarketlinks darkmarket 2025

dark markets https://github.com/darkwebmarketslinks/darkwebmarkets best darknet markets

darkmarket 2025 https://github.com/darknetmarketslist/darknetmarketslist darknet drugs

dark market https://github.com/darknetmarketlinks2025/darknetmarkets bitcoin dark web

The content is engaging and well-structured, keeping visitors interested.

darknet site https://github.com/darkwebwebsites/darkwebwebsites darknet markets url

darknet site https://github.com/darknetmarkets2025/darknetmarketlinks darkmarkets

dark web market list https://github.com/darkwebmarketslinks/darkwebmarkets darknet markets onion

darkmarket https://github.com/darknetmarketslist/darknetmarketslist darknet websites

dark markets https://github.com/darknetmarketlinks2025/darknetmarkets darknet market list

darknet markets url https://github.com/darknetmarkets2025/darknetmarketlinks dark web marketplaces

darknet market https://github.com/darkwebwebsites/darkwebwebsites darknet marketplace

dark markets https://github.com/darkwebmarketslinks/darkwebmarkets darkmarket list

darknet markets https://github.com/darknetmarketslist/darknetmarketslist dark web market list

darknet marketplace https://github.com/darknetmarkets2025/darknetmarketlinks darknet market list

The layout is visually appealing and very functional.

dark market link https://github.com/darknetmarketlinks2025/darknetmarkets darkmarkets

dark market 2025 https://github.com/darkwebwebsites/darkwebwebsites darknet drug market

darknet drug links https://github.com/darkwebmarketslinks/darkwebmarkets dark web market links

darknet drug market https://github.com/darknetmarkets2025/darknetmarketlinks darkmarkets

darknet market https://github.com/darknetmarketslist/darknetmarketslist dark web market links

dark market list https://github.com/darknetmarketlinks2025/darknetmarkets dark web link

darknet sites https://github.com/darkwebwebsites/darkwebwebsites darknet market lists

darknet drugs https://github.com/darknetmarkets2025/darknetmarketlinks dark web drug marketplace

darknet websites https://github.com/darkwebmarketslinks/darkwebmarkets darknet markets url

bitcoin dark web https://github.com/darknetmarketslist/darknetmarketslist dark web markets

The design and usability are top-notch, making everything flow smoothly.

darkmarkets https://github.com/darknetmarketlinks2025/darknetmarkets dark market list

darknet markets links https://github.com/darkwebwebsites/darkwebwebsites darknet markets 2025

dark market onion https://github.com/darknetmarkets2025/darknetmarketlinks darkmarket link

dark web link https://github.com/darkwebmarketslinks/darkwebmarkets darknet drug store

darknet markets https://github.com/darknetmarketslist/darknetmarketslist dark market onion

dark market url https://github.com/darknetmarketlinks2025/darknetmarkets dark web marketplaces

darknet markets 2025 https://github.com/darknetmarkets2025/darknetmarketlinks dark market url

dark web market list https://github.com/darkwebwebsites/darkwebwebsites dark markets

dark market list https://github.com/darkwebmarketslinks/darkwebmarkets bitcoin dark web

dark web markets https://github.com/darknetmarketslist/darknetmarketslist darknet markets onion address

dark web market https://github.com/darknetmarkets2025/darknetmarketlinks darknet markets onion

darkmarket url https://github.com/darknetmarketlinks2025/darknetmarkets dark market link

darknet markets onion https://github.com/darkwebwebsites/darkwebwebsites dark websites

darkmarket url https://github.com/darkwebmarketslinks/darkwebmarkets dark web market links

dark web link https://github.com/darknetmarketslist/darknetmarketslist darknet sites

darknet drugs https://github.com/darknetmarketlinks2025/darknetmarkets dark web marketplaces

dark market 2025 https://github.com/darkwebwebsites/darkwebwebsites dark web drug marketplace

The content is well-organized and highly informative.

darknet marketplace https://github.com/darknetmarkets2025/darknetmarketlinks darknet market links

darknet markets links https://github.com/darkwebmarketslinks/darkwebmarkets onion dark website

darknet markets onion https://github.com/darknetmarketslist/darknetmarketslist darknet marketplace

The design and usability are top-notch, making everything flow smoothly.

It provides an excellent user experience from start to finish.

The design and usability are top-notch, making everything flow smoothly.

The content is engaging and well-structured, keeping visitors interested.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

The content is engaging and well-structured, keeping visitors interested.

I love how user-friendly and intuitive everything feels.

The content is engaging and well-structured, keeping visitors interested.

It provides an excellent user experience from start to finish.

The layout is visually appealing and very functional.

The design and usability are top-notch, making everything flow smoothly.

A perfect blend of aesthetics and functionality makes browsing a pleasure.

Your article helped me a lot, is there any more related content? Thanks!

dark web market https://github.com/darkwebsitesyhshv/darkwebsites – darkmarket list

The layout is visually appealing and very functional.

darknet site https://github.com/nexusdarkrtv1u/nexusdark – darknet market

dark web sites https://github.com/aresonioncq0a7/aresonion – dark web markets

dark web marketplaces https://github.com/aresmarketdarknetl9khn/aresmarketdarknet – dark web market list

darknet market list https://github.com/abacuslink4jjku/abacuslink – darknet market list

dark web market links https://github.com/darkwebsitesyhshv/darkwebsites – dark websites

dark web market urls https://github.com/aresonioncq0a7/aresonion – dark markets

best darknet markets https://github.com/nexusdarkrtv1u/nexusdark – dark web market urls

darkmarkets https://github.com/aresmarketdarknetl9khn/aresmarketdarknet – darknet market lists

darknet websites https://github.com/abacuslink4jjku/abacuslink – tor drug market

darkmarket url https://github.com/aresonioncq0a7/aresonion – dark market url

onion dark website https://github.com/darkwebsitesyhshv/darkwebsites – dark markets

dark markets 2025 https://github.com/nexusdarkrtv1u/nexusdark – darknet markets 2025

darknet marketplace https://github.com/aresmarketdarknetl9khn/aresmarketdarknet – darkmarket

dark web markets https://github.com/aresonioncq0a7/aresonion – dark web sites

dark market list https://github.com/abacuslink4jjku/abacuslink – darknet site

dark market https://github.com/darkwebsitesyhshv/darkwebsites – darkmarket 2025

darkmarket url https://github.com/nexusdarkrtv1u/nexusdark – dark market onion

dark market onion https://github.com/aresonioncq0a7/aresonion – dark market link

dark market https://github.com/aresmarketdarknetl9khn/aresmarketdarknet – dark markets 2025

dark markets 2025 https://github.com/abacuslink4jjku/abacuslink – onion dark website

darknet markets onion https://github.com/darkwebsitesyhshv/darkwebsites – dark market

dark web link https://github.com/nexusdarkrtv1u/nexusdark – dark markets

dark market url https://github.com/aresonioncq0a7/aresonion – dark web market

dark web market urls https://github.com/aresmarketdarknetl9khn/aresmarketdarknet – darknet links

darknet drug market https://github.com/abacuslink4jjku/abacuslink – dark market list

darkmarket url https://github.com/darkwebsitesyhshv/darkwebsites – dark market onion

darknet markets onion address https://github.com/aresonioncq0a7/aresonion – dark web market list

darknet markets onion https://github.com/nexusdarkrtv1u/nexusdark – darkmarket

best darknet markets https://github.com/aresmarketdarknetl9khn/aresmarketdarknet – dark web link

dark market onion https://github.com/abacuslink4jjku/abacuslink – onion dark website

darknet drug links https://github.com/aresonioncq0a7/aresonion – darknet drug links

darknet websites https://github.com/darkwebsitesyhshv/darkwebsites – darknet markets

darkmarket list https://github.com/nexusdarkrtv1u/nexusdark – dark web market

dark web markets https://github.com/aresmarketdarknetl9khn/aresmarketdarknet – darkmarket list

tor drug market https://github.com/aresonioncq0a7/aresonion – darknet drug store